Oil traded lower today as traders braced for a weakening in demand next week after Irma’s projected path through the southeast will drastically reduce economic activity.

The latest trajectory of Irma has it making landfall in South Florida early Sunday morning and steering directly up the entire state of Florida and then barreling into the other southeastern states on Monday and Tuesday. In preparation for the storm, the already gas-deprived region due to refinery and pipeline disruptions as a result of Harvey, gas supplies were being hauled into Florida from other states to allow evacuation for Floridians. Because of the projected severe devastation that will impact Florida, refined products will not be in high demand for a few days early next week because many people won’t be able to travel. This poses a risk that the NYMEX oil complex may sell off early next week, but rack prices may stay bid because of the on-going tight fuel situation stretching all the way north into Maryland.

Reuters reported today that Saudi Arabia will be limiting its allocations to customers in October to 350,000 barrels per day. This would keep Saudi Arabia in line with committing to its supply cuts of 486,000 barrels per day, despite reported strong demand from refiners.

Investment bank Jefferies is expecting a “near-full” recovery in refining capacity despite the devastation to the Houston energy hub caused by Harvey. They are expecting no more than 800,000 barrels per day of refining capacity shall remain offline by the end of September. This is pretty remarkable considering the fact that about 4,500,000 barrels per day of capacity was shut in at one point due to the storm. Currently, there is about 1,600,000 barrels per day still shut in. As these refiners come back online, expect prices of refined products relative to the price of crude oil to come down significantly on the NYMEX level.

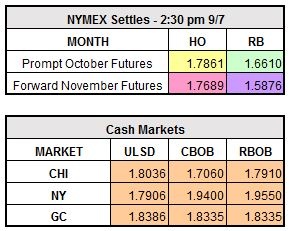

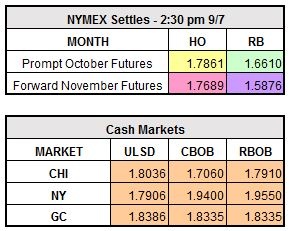

October WTI currently is trading down $0.84 to $48.25/barrel, RBOB is unchanged at $1.6610/gallon, and ULSD is lower by $0.0077 to $1.7784/gallon.