The oil patch traded broadly lower today on a forecast of increased month-to-month OPEC production and position squaring before Monday’s OPEC/non-OPEC meeting in St. Petersburg, Russia.

Reuters reported today that Petro-Logistics, a consultancy, released a report that predicts OPEC’s production this month will rise 145,000 barrels per day to over 33 million barrels per day. Much of the hike in supply will come from Saudi Arabia, UAE, and Nigeria.

This report hit the newswire before the OPEC/non-OPEC meeting on Monday, which is being hosted in St. Petersburg, Russia. Many analysts believe the group will discuss whether or not to cap production on Nigerian and Libyan production as well as any additional production cuts for all members. However, a lot of traders are skeptical anything substantial will result from the meeting. This is contributing to the fact that traders are taking profits today as September WTI is currently trading down $1.12 to $45.80/barrel.

The oil market has been rallying for over a month now, up over $4/barrel as a matter of fact. Let’s also keep in mind that after the last OPEC meeting, held on May 25th, the market sold off over $2/barrel on the day of its decision to extend production cuts. Therefore, some traders are using the rally we’ve had along with this pattern of thinking to justify a down market today.

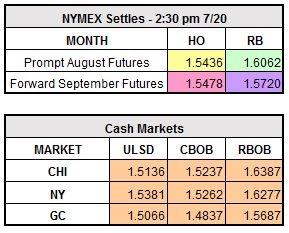

August RBOB is down $0.0378 to $1.5684/gallon and ULSD is lower by $0.0265 to $1.5171/gallon.