Gasoline stockpiles are nearing all-time seasonal highs in the United States. According to Bloomberg, within the last few weeks, a minimum of five vessels carrying gasoline were turned away at the New York Harbor as they arrived to unload product. In addition to this report, the International Energy Agency reported on Wednesday that some ships are storing cargoes at sea since there is no room on land to store product.

Stockpiles are at or near all-time seasonal highs in the US, but it’s a pretty similar story if you travel across the globe to the Asian-Pacific region. As China continues to ramp up refining, the supply glut seems to be worsening in the United States and in the world in general.

For those of you who are wondering how the excess of gasoline started, here is a quick summary that relates to crack spreads:

The global gasoline oversupply is occurring for many reasons that go beyond the U.S. and China. Some of the biggest drivers of this are the refiners. On a global scale, refineries started to ramp up production of gasoline in the first quarter to make up for incredibly weak crack spreads for diesel.

What is a crack spread?

A crack spread is a rough measurement of the profit made from turning a barrel of crude oil into a refined fuel (gasoline, diesel, etc). In order to calculate a crack spread, you must take the difference between the price of crude and the refined petroleum product/s that are derived from the crude. The formula is product price ($/gallon) x 42 (gallons/barrel) less crude price ($/barrel). Typically in the U.S., a barrel of crude will yield 2 parts gasoline and 1 part diesel (aka 2-1 crack).

In the first quarter of the fiscal year, crack spreads fell to $8.46 a barrel for diesel, when a year earlier they were at $15.28. During that same time period, gasoline crack spreads improved, going from $8.66 to $11.94, prompting the refiners to produce more gasoline to improve their profitability.

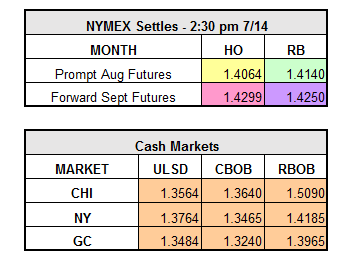

As of 11:53 am EST, Heating oil (distillates) is even on the NYMEX, while RBOB is up .0158 cents.